4 Best Practices for Your Next Risk Assessment

Risk assessments play a vital role in an effective risk management program for regional and community financial institutions (FIs).

Conducting these assessments helps identify and evaluate high-risk areas. In the long run, well-executed assessments will position your organization to adhere to industry standards, avoid unfavorable findings on regulatory exams, and steer clear of any costly penalties.

But what’s the best way to conduct and track a risk assessment for banks and credit unions? For many risk management leaders, the answer lies in combining industry best practices with risk management software.

WolfPAC® is here to help on both fronts. Our risk management software is trusted by over 6,000 risk management professionals.

You can also download our free guide, “Preparing for FI Regulatory Exams: A Guide for Risk Management Pros,” to access insights from two of our in-house risk management experts: Lisa Spampinato, Director of Implementations, and Puja P. Ghiya, Director of Product.

Preparing for a Regulatory Exam? Download Our Free Guide!

Let’s dive deeper into conducting risk assessments for banks and credit unions and discuss some best practices.

What is a risk assessment?

A risk assessment in banking is an internal process used to identify and prioritize risks, and document mitigating controls related to regulations, technologies, third parties, or business processes/functions. Conducting thorough risk assessments allows financial institutions to evaluate their risk posture while proactively addressing any vulnerabilities.

4 focus areas for risk assessments

Many risk management teams will conduct assessments regularly. This helps them stay prepared for potential regulatory exams.

As Lisa and Puja point out in our guide, FIs should focus their risk assessment efforts on a few main areas:

1. Financial Risk

Every risk assessment program should encompass evaluations of the financial risks facing the organization. These assessments should cover focus areas like credit, interest rate, liquidity, and pricing risk (“market risk”). While acknowledging that these are high-risk areas for any organization is important, conducting the assessments helps document the controls you’ve established to mitigate these risks. This information can be used to support the organization’s growth and efficiency.

2. Consumer protection

Consumer protection is a highly scrutinized, hot-button issue that’s often in the news. For example, the Consumer Financial Protection Bureau ordered TD Bank to pay $28 million for actions that jeopardized consumer credit reports. Other areas receiving scrutiny are debt collection, overdraft fees, and auto lending.

Risk assessments of consumer protection regulations such as Truth in Lending or Fair Credit Reporting Act help identify which regulations are high risk to the organization and document the controls in place to help form a strong consumer protection program.

3. Fraud and suspicious activity

The rise of generative AI and deepfakes is increasing the pressure on the financial sector to enhance its anti-fraud programs. Operations or Transaction risk assessments help identify those business processes at a higher risk of fraud. Controls should be in place to mitigate the activity. You should also frequently assess your technologies and understand how they factor into fraudulent or suspicious activities.

As regulation requires, a robust Bank Secrecy Act risk assessment can help identify the products/services, customers, and locations that increase the risk for money laundering activities and other financial crimes.

4. Cybersecurity and IT

Your FI’s cybersecurity and information technology infrastructure should always be a primary focus area of your risk management programs. Scheduled risk assessments will help ensure you’ve downloaded all recent application updates and cybersecurity patches, complied with multi-factor authentication (MFA), and have adequate response plans in the event of data breaches or hacks.

Lisa and Puja recommend resources such as the InfoSec handbook, which provides guidance on the latest best practices and mandates.

4 best practices for risk assessments

Now that we’ve discussed the major focus areas for your risk assessments, it’s time to lean deeper into Lisa and Puja’s expertise. Here are four tips to create a strong risk assessment program:

1. Consistency and integrity

Remember that the goal of bank risk assessments is to identify and assess high-risk areas to help protect your organization. A risk assessment is meant to be an honest analysis of your risks and controls. It’s actually a good thing if your assessment unearths a gap or lack of controls because it’s better for your team to identify it than a regulator or auditor.

When it comes time for an exam, you must support your responses in the assessment. Stating a control is strong, when an auditor may have issued findings or internal testing uncovered deficiencies will lead to higher scrutiny for that program by the examiner.

2. Emphasize controls in high-risk areas

Regional and community FIs such as yours are fast-moving institutions. Resources can be limited, and each day’s to-do list is jam-packed. That is why it’s important to focus your time and resources on the areas you deem most risky for your organization. Each FI is different, so customize this approach. Not every risk assessment needs to be updated annually; prioritize your resources to maximize your impact.

3. Create action plans to address gaps

Let’s say you’ve conducted a risk assessment and identified a high-risk area with inadequate controls. Don’t panic!

In Lisa and Puja’s experience, regulators don’t expect perfection. They do, however, want to see evidence that you have a strategy in place to improve any weak spots. As a result, you should make an organized, good-faith plan to mitigate that risk with concrete, actionable steps.

In many ways, the assessment itself isn’t the most important part of the equation. It’s the actions you take in response that matter most.

4. Implement an integrated risk management solution

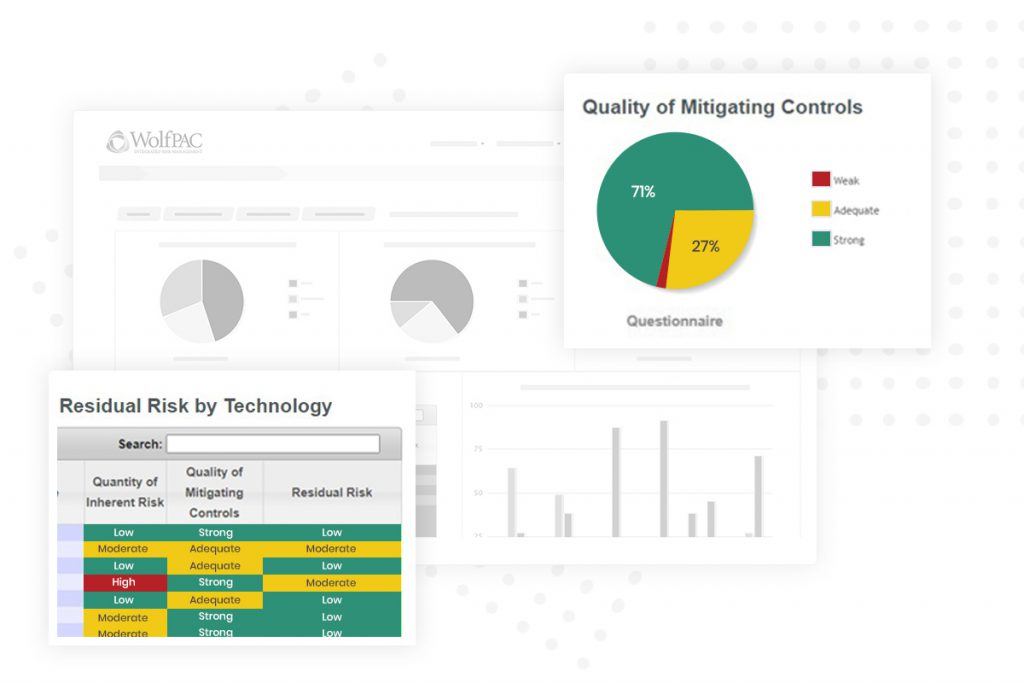

Given the complexity of the current risk landscape, running your entire risk management program with Excel spreadsheets isn’t sustainable. Automated risk management software minimizes human error, improves accuracy, and reduces the burden on time-strapped risk management teams.

WolfPAC’s Integrated Risk Management® solution automatically displays the dates associated with your risk assessments and suggests when they should be updated. That’s the kind of smart automation that will make a difference for your organization.

How WolfPAC can accelerate your risk assessment efforts

Risk assessments can bring about a lot of anxiety or eye-rolling from business lines. But with a little help, bank risk assessments can feel empowering, rather than draining.

WolfPAC® offers a seamless, user-friendly risk management platform tailored for financial institutions, healthcare organizations, and FinTech companies. WolfPAC Integrated Risk Management® is a fully integrated suite of software and services to help supercharge risk assessments, tracking, and reporting processes. Backed by the expert guidance of Wolf & Company, WolfPAC® combines the power of technology with expert insights.

WolfPAC® customers can get started in weeks – not months — and consistently monitor risk and controls for their FI. Click here to learn more, and don’t forget to download our free guide on preparing for your exams!

Related Reading:

- Why Automated Risk Management Beats Spreadsheets and Manual Methods

- 5 Best Practices to Prepare for Your Next FI Regulatory Exam

- Free Regulatory Exam Prep Guide