Understanding Your Bank’s Risk Profile

For years now, Wolf & Company has written numerous articles and given frequent educational presentations to directors and managers on the value of understanding the risk profile of their institution.

Board & Management Must Agree on the Risk Profile

It’s crucial that your board and senior management team agree on a risk profile. This alignment leads to a discussion on the appropriate balance between risk and reward and, therefore, expected returns to the shareholders.

No discussion of risk/reward can be had without a conversation about strategic planning and the strategic objectives of the institution. Non-bank payment and lending companies pose a growing threat to the banking industry. As a result, the strategic planning process can yield value well beyond the expansion of traditional banking products and services and corroborate the results of the enterprise risk assessment.

Formulating Your Risk Profile

If our institution’s objectives are to offer an array of products to a targeted group of customers operating within a defined geographic boundary, we have a strategic plan. However, achieving these objectives requires another layer of planning to be articulated by management. By asking, “What can go wrong?” you begin to link your strategic objectives to risk management. This question is where the conversation moves from “what if” to actionable processes to mitigate risk.

- Current control procedures focus on how we safely process transactions today.

- Performance indicators inform us on how we execute over time.

If we are thoughtful in our risk management approach, we aren’t spending $10 on control to protect $2 of assets. The next step is to look outward to project how the business and regulatory landscape may change and impact our future strategic objectives and financial returns.

Next Steps:

Our industry needs a unified approach. One that combines all these elements to inform us of the institution’s risk profile, which contributes to the predictability of earnings. The absence of measuring and understanding the enterprise risk profile jeopardizes the likelihood that our strategic initiatives will return value. And the lack of an enterprise risk assessment and a strategic plan threatens the franchise.

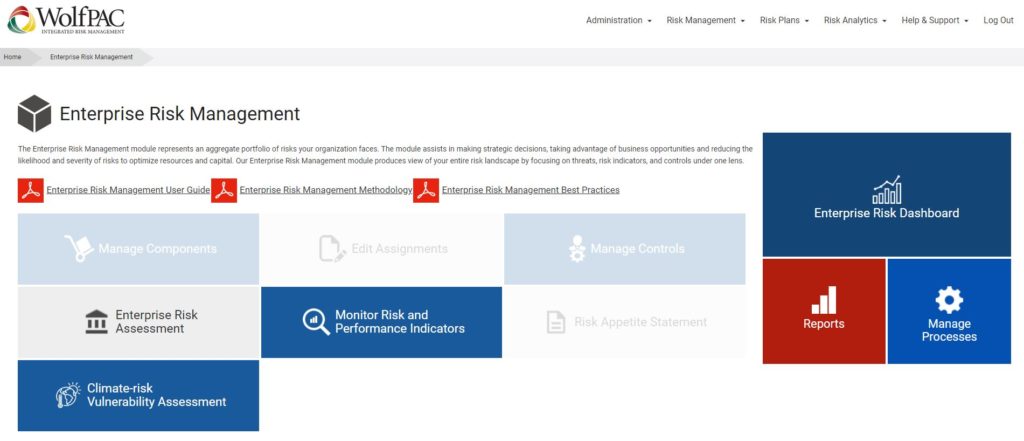

WolfPAC’s Enterprise Risk Management software module is the perfect way to get moving in the right direction. Our ERM software provides everything your institution needs to develop and maintain an effective risk management program that stands up to the threats of today and tomorrow. For more than a decade, the nation’s top banks and credit unions have used it to:

- Better understand their risk tolerance,

- Develop tailored solutions to current threats, and

- Create impactful strategies to better plan for the future.