Increase in Staffing Headaches for Financial Institutions

Author: Ron Taché

Assembling the Right Team at Financial Institutions is Difficult and Only Getting Tougher

Staffing challenges at financial institutions are considerable and are very likely to get larger. Every business and organization has a mix of generalists and specialists. For example, banks and credit unions employ specialists in areas including:

- Legal,

- Financial,

- Information technology, and

- Risk management.

While some of these responsibilities can be outsourced to consultants who work with multiple organizations, even mid-sized institutions often find it more cost-effective to employ full-time specialists. In addition, the sheer number of tasks that need to be done regularly can make using outside consultants too expensive.

However, as the twenty-first century rolls on, finding and retaining such experts is proving to be consistently difficult. Factors in the broader economy, coupled with certain unique aspects of financial institutions, point to a future where the availability of specialists will drop further.

Fortunately, there are steps that executives can take to mitigate staffing challenges by:

- Increasing the retention of specialists already on their teams, and

- Making these roles more attractive to new hires.

Flexibility, scheduling creativity, and inclusion make workplaces more appealing. In addition, prudent investments in technology can reduce the need for large teams of specialists.

Defining the Broader Staffing Challenge

1. Employees are more mobile than ever.

While the idea of staying with a single company for decades became unusual long ago, workers now have more options than ever before. Remote working options mean companies often compete with firms nationwide (and occasionally worldwide) for talent. With unemployment below 5% since 2016 (except the anomalous COVID-induced shutdown), few employees are grateful for their specific job. Many are willing to change roles with limited notice and little justification.

2. Retirement dates are unpredictable.

Some workers are willing to work through traditional retirement ages, but others start the process in their early fifties. The 4x runup in the S&P500 since the financial crisis in 2008-2009 has strengthened retirement accounts for many workers in their 50s and 60s. The gig economy (Uber, Instacart, Upwork) provides options for workers seeking less structure while not fully retiring. COVID even made some workers rethink their life expectancy and priorities. From a management perspective, any worker over 50 is a candidate for retirement or resignation. How many of us have succession plans in place for key contributors that young?

3. The size of the U.S. workforce has stagnated.

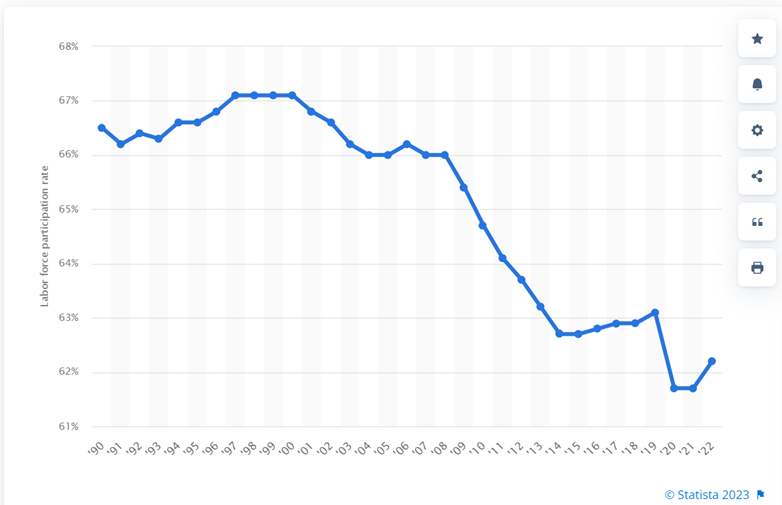

As the baby boomers (and even the oldest Gen Xers) hit the retirement age, the number of workers aged 18-65 has been roughly flat since 2018 and is highly unlikely to increase in the coming decades. Additionally, even within that newly stagnant cohort, the percentage of people working, as measured by the U.S. participation rate, is also dropping. The rate hovered around 66%-67% for almost 20 years (1990-2010) but has dropped steadily for nearly 15 years. Will hybrid or fully remote work arrangements stem the tide and coax more workers off the sidelines?

Financial Institutions’ Specific Challenges

Some staffing challenges are more complicated for financial institutions than other types of businesses. Even during COVID, many, perhaps most, organizations resisted offering remote work options to team members. Given the long history of well-staffed branch offices, remote work will be limited for certain roles. Justifiably, leadership teams hesitate to further isolate front-line workers from their back-office teammates by providing a different, often attractive, working arrangement for that subset of the team.

1. The Teller Pipeline Is Drying Up.

Historically, tellers have been a great source of talent, and the role allows the organization to train and evaluate early-career professionals. Now, there are far fewer tellers. The combination of banking by application and the consolidation of financial institutions has led to fewer branches and, therefore, fewer tellers for several decades. In addition, many tasks historically handled in branches that required a teller are now conducted electronically.

Since the teller role has long been a great starting point for a career within financial institutions, this important pipeline is slowly drying up. Even though we can attribute much of the branch reduction to megabanks, those are still early-career professionals who often migrated to smaller institutions at some point in their careers.

2. Less Accounting Grads are Entering the Workforce.

Financial institutions are competing for workers, along with every other industry. One proxy for interest in financial careers is the number of people graduating with an undergraduate degree in accounting. Unfortunately, that number has been trending downward in recent years. After peaking at 57k in 2012, it dropped to 52K by 2020. An accounting degree is certainly not a must for most positions in a financial institution. Still, a general decline in students focused on a related field like accounting is worrisome since it may indicate less interest in financial careers. Recent reports of staffing shortages at the FDIC only reinforce these concerns.

3. FIs Face Stiff Hiring Competition from Other Industries.

Key roles in financial institutions require highly specialized expertise and experience that few other companies prepare workers for. Virtually no industry receives the heightened degree of regulatory oversight experienced by banks and credit unions. The reporting requirements, the amount, and the complexity of regulations really do make them unique.

While every company has good reasons to worry about cybersecurity, few involve the elevated stakes at financial institutions. Not much compares to the prospect of having your savings account wiped out. The lure of immense and immediate gains by criminals makes financial firms nearly irresistible as targets. The discipline of risk management may be nascent and emerging in other industries, but it has been a mainstay at banks for decades. When hiring for compliance, cybersecurity, or risk management roles, financial institutions are unlikely to find many strong candidates outside the ecosystem.

Working for a bank or a credit union is a respectable career choice. However, it is not generally portrayed as being dynamic like one in technology might be. It’s also not as purpose-driven as one associated with environmental issues, nor as in-demand as one in the medical field (see “traveling nurses”). In addition, financial institutions generally don’t offer the “lottery ticket” of stock options awarded in technology start-ups or even more conventional publicly traded companies.

4. Flexible Scheduling is Tough for Many FIs.

To complicate things further, while retail banking frequently involves up to six customer-facing days per week, some companies are experimenting with four-day work weeks. That leaves financial institutions in an even weaker position when competing for talent. One credit union is even experimenting with shortening the work week. Per a March 23, 2023, story in the Credit Union Times, Oregon Community Credit Union is conducting a pilot where some “team members would work four eight-hour shifts and be ‘compensated at a rate equivalent to what they would have been paid for five eight-hour shifts.’”

Unfilled Positions Result in Obvious and Hidden Problems

1. When key positions are vacant, work doesn’t get done.

Every organization must do things, like interacting with clients and paying employees, vendors, and taxes. Additionally, organizations must complete activities that seem like good ideas but are often postponed, such as:

- Implementing efficiency projects,

- Enhancing employee training programs, and

- Formulating strategic plans.

In understaffed organizations, those latter tasks, often called “nice to haves,” are frequently postponed. Over time, tasks originally considered mandatory may also be overlooked, even “just for now” or “until next year.” One year becomes two, and the organization normalizes the lack of attention to strategic planning, capital projects, or thorough risk management.

2. Some understaffed organizations don’t eliminate tasks but devote less time to them.

For example, imagine a strategic planning process that ought to:

- Start with an employee survey,

- Follow up with a client survey, and

- Conclude with a 2-day offsite.

The understaffed organization may jump directly to the offsite and conduct the session in one afternoon instead of two full days. As a result, the team feels like they are pulling out of day-to-day tasks and thinking long-term. But with minimal preparation and a narrowed time window, the impact of the session will probably be drastically reduced.

Similarly, an organization may fill a vacancy by asking an existing team member to take over the vacated responsibilities. Assuming this person already had legitimate full-time responsibilities, there are now two functional areas that are likely to get reduced attention.

There is also the question of qualifications and training for the person asked to take on the new tasks and oversight. Sometimes, the person asked to do double duty may even end up alienated or discouraged. In extreme cases, the overwhelmed team member may seek alternate employment outside the organization. Again, the purported solution to a staff vacancy ends up exacerbating the situation!

Planning for Ongoing Staffing Challenges and Thriving Despite Them

Despite the challenging staffing environment, which is unlikely to get significantly better for many years, there are clear steps executives can take to ensure that they fill relevant positions and complete critical tasks consistently. One obvious path to easing staffing challenges is to increase the retention rate. In other words, keep your existing team with the organization for as long as possible. Flexibility and creativity will make that more likely in the competitive environment described above.

1. COVID provided vast portions of the U.S. workforce with a solid reason to experiment with remote working.

While the results may not have been universally positive, many companies have seen productivity increases or at least have not experienced a decrease in productivity. Workers generally appreciate the reduction or elimination of commutes. If a worker had been commuting 15 minutes each way, five days per week, they were spending approximately 120 hours per year commuting. Cutting that in half yields 60 hours in saved time each year, more than a workweek. Even with modest accommodations, something like allowing one day of remote work per week is likely to be well received by employees. It also sends the signal that executives are open to new ideas.

2. Financial institutions can also consider modifications to other policies.

For example, reassessing dress codes in a world where formal business attire is becoming rare may help with employee satisfaction and retention. While this is generally a departure from banking conventions, workers appreciate the opportunity to avoid traditional business attire, particularly suits, ties, and skirts. Creativity regarding family leave policies can also help with retention and recruiting. Generous maternity and paternity leave can enable mid-career professionals to stay with an organization during and after significant life changes.

3. Workers generally desire more input into decision-making and more transparency around corporate decision-making.

Forward-thinking organizations include a broader set of team members in decision-making and policy setting. As a result, employees are more likely to embrace the changes they helped shape. They notice when senior management listens to their input, even if every recommendation is not adopted.

4. Providing Career Paths for Workers Without College Degrees.

While banks and credit unions have traditionally provided good career paths for those without college degrees, institutions may want to look for areas to expand such policies.

- IBM made headlines as far back as 2016, touting its intent to hire non-degree holders into “new collar jobs.” IBM’s Chief Human Resources Officer reminded readers in 2021 that “the half-life of skills is shortening, which means all workers require constant training.” The same article noted that nearly 50% of IBM’s roles are open to anyone with the right skills, i.e., including people without a four-year degree.

- In 2022, the state of Maryland announced a policy shift opening the vast majority of state jobs to non-degree holders. Utah, Pennsylvania, and Alaska have followed suit.

Increasingly, the knowledge and skills required to be an effective information security worker or risk management professional are more likely acquired via experience than via a college or university.

5. The possibility of employing technology to reduce the hours required to execute critical tasks is often overlooked.

Note that if a department requires 8,000 hours of work per year, the department needs to employ five people. Reduce the requirement to 6,500 hours, and you only need four. Financial institutions have a strong history of employing labor-saving technologies – consider bill counting machines or anti-money-laundering software. However, some institutions have stagnated.

Merely using spreadsheets is not fully leveraging available technology. This is especially true if team members spend hundreds of hours per year manipulating those spreadsheets. Myriad software applications exist expressly to reduce repetitive tasks. One simple example concerns the management of vendors where automated notifications regarding contract renewal reviews, coupled with workflow software that tracks due diligence progress, increase effectiveness and save time. Even periodic reviews of how and why an organization executes specific tasks will likely identify time-saving opportunities. There may even be tasks that can be eliminated.

6. Another area that merits investigation and monitoring is artificial intelligence (AI).

This burgeoning space may reduce the need for years or decades of specialized training via tools. For example, imagine getting a robust answer to a question like

- “What are all the regulations I need to comply with if I am going to start making multi-family loans in Hartford, CT?”, or

- “Analyze my AML procedures for gaps compared to best practices among leading banks.”

While few institutions are ready to rely too heavily on such engines today, there may be near-term ways to expand the capacity of a single in-house expert via their use.

The term employee value proposition (EVP) has gained traction recently among human resources professionals. The items above all contribute to a workplace that employees will choose despite other options. In other words, they result in a compelling value proposition.

Conclusion

Staffing at financial institutions has become very challenging for multiple reasons ranging from demographic trends to educational shifts and the decoupling of location from job opportunities. Staffing challenges will only increase in the coming years. However, banks and credit unions can ensure that mission-critical tasks get accomplished by thinking creatively about retention and hiring while also expanding the use of technology to reduce the need for new hires.