Vendor Management Case Study: Pentucket Bank & WolfPAC Solutions

Note:

Stephen Palladino participated in this case study for Pentucket Bank. Since the case study was conducted, Pentucket Bank and Newburyport Bank formed a strategic alliance. Stephen is now operating the Vendor Management programs for both entities and appreciates that both banks use WolfPAC for their respective Vendor Management operations.

“It certainly makes the process of bringing the two programs together much easier.”

– Stephen Palladino

Background:

Pentucket Bank is a Haverhill, MA-based community bank with over 130 years of history and nearly $1 billion in assets under management. WolfPAC helped the client build and maintain a comprehensive vendor risk management program that provides complete visibility into its 3rd party relationships.

This new level of expertise, automation, and transparency enables Pentucket Bank to:

- Cultivate strong vendor relationships that add value to the institution and keep the bank and its customers safe.

- Improve vendor performance and reduce 3rd party risk.

- Meet the rising expectations of the board, risk committee, auditors, and regulatory examiners.

- Keep its 130+ year promise to customers, “Happy customers. Growing businesses. Stronger communities.”

The Challenges:

Managing a growing network of vendors is a complex and resource-intensive process that most community banks can’t handle alone. This dynamic exposed the bank to many avoidable risks, challenges, and expenses.

Other key challenges:

- Significant Growth: The client has grown from an asset size of $646 million in 2013 to nearly $1 billion in 2023. With this expansion comes increased scrutiny from regulatory agencies.

- Keeping its Promise to Customers: “Happy customers. Growing businesses. Stronger communities.” That’s been Pentucket’s commitment to customers since 1891. A big part of fulfilling that obligation is providing top-notch services. As a result, the bank must ensure it consistently maintains the right mix of vendors.

- Complexity & Evolving Risk Environment: Maintaining a strong vendor management program is hard work, especially for a growing community bank. There are simply too many documents, data points, people, regulations, and risks to manage manually. In addition, the skyrocketing growth of cyberattacks and data breaches on third parties has community banks on high alert.

The Solution:

As a longtime Wolf & Company customer, Pentucket Bank knew where to turn for help. The client leveraged WolfPAC’s 3rd Party Risk Management Software and Wolf & Company’s Virtual Vendor Management (vVMO) Services to modernize and enhance its TPRM program.

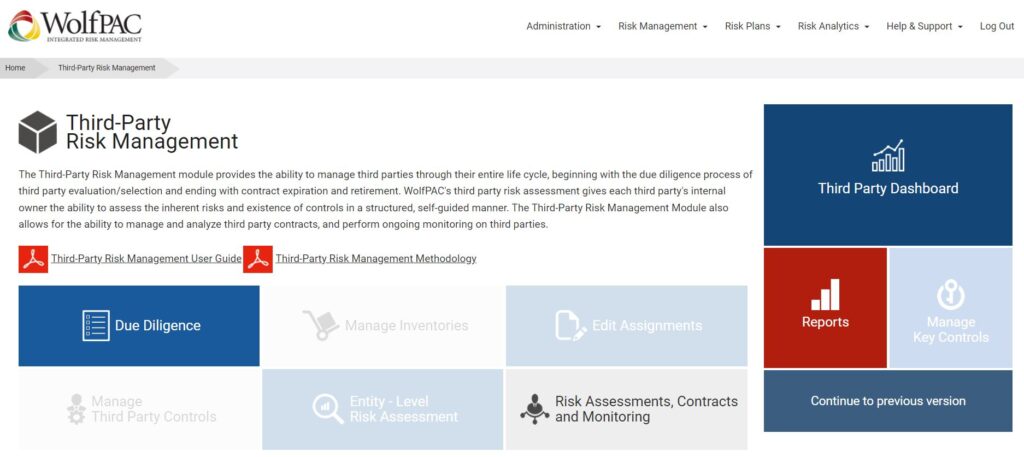

WolfPAC’s Third-Party Risk Management Software:

WolfPAC’s TPRM software module provides the functionality, automation, and visibility the client needs to strengthen its security posture. The tool gives Pentucket Bank everything it needs to effectively manage vendor risk across its entire organization in one fully integrated platform that’s easy to implement and use. As a result, the client can now manage every step of the vendor lifecycle in one place, including:

- Vendor due diligence,

- Vendor selection and contract negotiation,

- Contract analysis & renewal management,

- Ongoing 3rd-party monitoring and reporting, and

- Risk management.

“We needed a system that would enable us to conduct our risk assessments, ongoing monitoring tasks, due diligence projects, contract management, and reporting all in one place. WolfPAC does just that!”

– Pentucket Bank Vendor Risk Program Manager Stephen Palladino

Wolf & Company’s Virtual Vendor Management Officer (vVMO) Services

Wolf’s team of vendor management experts guided Pentucket Bank and their new vendor manager through every step of the software onboarding and vendor lifecycle development process, including:

- Helping with account set-up and giving guidance on best practices, policies, and procedures; and

- Providing in-depth training on every aspect of the vendor management process, including conducting risk assessments, regulatory adherence, vendor due diligence, and vendor monitoring tasks.

“The implementation and consulting process with Wolf & WolfPAC was fantastic! It helped me develop a deeper understanding of both my job and the world of risk management. I was very fortunate to have such a solid launching pad.”

– Pentucket Bank Vendor Risk Program Manager Stephen Palladino

Results:

Pentucket Bank now has the third-party risk management program it wants and needs. As a result, the client is now better positioned to properly assess, monitor, and reduce risk related to each of its 3rd party relationships.

Other key results:

- Happy customers. Growing businesses. Stronger communities:By automating and improving its vendor lifecycle management process, the customer can ensure that every vendor in its network helps meet its goal of better serving the needs of its customers and communities.

- Business Impact: Working with WolfPAC is helping the client reduce expenses, drive improved vendor performance, better manage 3rd party risk, and ensure successful regulatory exam results.

- Part of the Pack! The client feels heard, supported, and like part of the WolfPAC team. In addition, Pentucket’s new vendor manager has a direct impact on the future of the product. He’s recently joined WolfPAC’s client advisory board and TPRM working group and regularly attends WolfPAC user events. He’s also become a valued part of his institution due to the success of his vendor management program.

“I loved Wolf & WolfPAC from day one. What I like the most about the software is the ability to manage every aspect of our vendor management program in one centralized location. This new capability helps make the hard work associated with risk management easier for me and my team. It’s also easy to use and train others and puts me in the best possible position to build the program that Pentucket Bank wants and needs.”

– Pentucket Bank Vendor Risk Program Manager Stephen Palladino

Next Steps:

Do you need help building a modern vendor management program that propels your organization forward?

- WolfPAC has a team of 3rd party risk management experts that are eager to assist.

- We also have one of the most robust third-party risk management software offerings available.